Wage inflation is becoming increasingly relevant to businesses worldwide. It poses a significant challenge to companies of all sizes, from SMBs to enterprises, as they strive to balance between managing employee expectations and maintaining their financial stability. When it comes to preserving a company’s bottom line, it is essential to consider the impact of rising labor costs and develop strategies to address them accordingly.

The cost of inaction can result in reduced profitability, employee dissatisfaction, and compromised quality of work. Therefore, practical strategies such as raising rates, assessing the client base, and switching to lower-cost resources can help organizations mitigate wage inflation. By thoughtfully navigating their unique circumstances, companies can maintain their competitiveness, profitability, and organizational integrity.

Raising Rates

First, businesses can adjust their pricing model. A simple solution is to raise rates to offset increased labor costs. However, it’s important that the rate increase is reasonable and aligns with market demand. One way to approach this is by conducting market research to identify the going rates for similar products or services in the industry.

Companies can also implement tiered pricing structures, where customers can choose from various pricing options that reflect the level of service they require. This approach enables businesses to cater to a broader range of customers and allows them to adjust pricing without affecting their competitive advantage.

Ultimately, companies should approach their pricing strategies with thoughtfulness and transparency. The rates must reflect the value they provide to their customers. Customers pay for value. If an organization delivers value to its client base and increases pricing in line with the market, raising rates should not raise eyebrows.

Assessing the Client Base

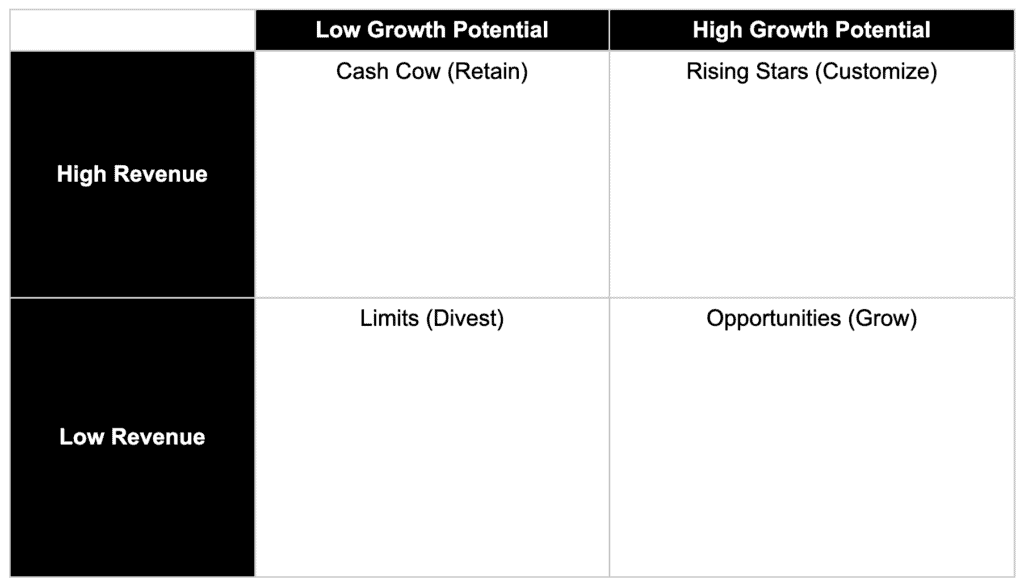

Next, businesses need to examine their customers. A growth matrix provides a strategic approach for client evaluation. The matrix plots clients on a chart with four quadrants: high revenue, low revenue, high growth potential, and low growth potential.

A company then places each of its customers into the proper quadrant. High Revenue and Low Growth Potential customers are Cash Cows. These customers need to be retained and appreciated for their consistency. The High Revenue and High Growth customers are Rising Stars. These clients need customized strategies and hands-on attention to reach their full potential. Low Revenue and Low Growth Potential customers are Limits. You should divest energy and effort here. Lastly, Low Revenue and High Growth Potential customers are Opportunities. Grow these low-revenue customers until they become high-revenue customers

When organizations examine their client base, clarity emerges. Businesses can make informed decisions about sales and pricing strategy when they understand in which quadrant each customer falls. Adjusting client relationships should increase profitability. High profitability can then offset rising labor costs

Companies must consider their values when assessing a client base. Maintaining great relationships is essential. Businesses can decide if they wish to adjust pricing based on customer type. This approach can avoid conflict with legacy clients and identify which customers to bill at a high rate with no expected conflict.

Regardless of how a business assesses its base, it should only implement changes that ensure a smooth transition and maintain a positive client relationship.

Switching to Lower-Cost Resources

Lastly, organizations should identify opportunities to switch to lower-cost resources. This approach helps businesses maintain their current prices while improving profit margins. However, it’s essential to ensure that shifting to new resources does not compromise quality.

For instance, businesses need to be diligent when shopping for new suppliers. Finding new vendors that provide the same value at a lower price point may take time. When done correctly, businesses can reduce their expenses while maintaining the quality of their products or services

For certain businesses, downsizing the size of an office or going fully remote is an option. By eliminating the need for a physical workspace, there are savings for rent, utility bills, and other expenses. Remote work also provides employees with greater flexibility and work-life balance, which can lead to increased job satisfaction and productivity. When employees feel fulfilled, the demand for higher salaries decreases.

Outsourcing is another option. Outsourcing tasks such as accounting, marketing, or customer service can help businesses reduce their expenses while still providing quality service to their customers. Much like changing suppliers, it is important to ensure that the quality of work or the output of the outsourced tasks maintains the same level as the company standard.

Finally, businesses can reduce costs through automation. Automating processes such as data entry, communication, inventory management, or customer support can reduce their reliance on human labor and improve overall efficiency. Additionally, automation can provide businesses with real-time data insights, enabling them to make more informed decisions and optimize their operations. By embracing automation, companies can reduce labor costs, improve productivity, and maintain their competitiveness in the market.

Conclusion

Wage inflation is a critical challenge for businesses of all sizes. But with pragmatic solutions, companies can navigate rising labor costs while maintaining profitability. By raising rates, assessing the client base, and switching to lower-cost resources, companies can retain top performers without drastically hurting the bottom line. The biggest challenge is maintaining the quality your customers expect when dealing with these changes.

People are a vital investment for any business. Every organization wants to retain its top contributors. There’s an opportunity for companies to take care of their people without it drowning their margins. It just requires skilled maneuvering and planning.